Company news

The fleet is aging! The ship type has a new dawn!

As the fleet ages, there seems to be a glimmer of hope for the future of the LR1 and Panamax tanker markets.

Shipbroker Gibson pointed out in its latest weekly report that the LR1/Panamax tanker market has long been regarded as a dying "sunset" sector, especially as investment in new ships has been almost zero in the past many years. From 2016 to 2022, only 9 new ships have been ordered for the entire LR1/Panamax tanker fleet. In addition, demand has also encountered multiple headwinds, with demand for clean LR1 transport declining slightly, while dirty cargo Panamax trade volumes have declined significantly. Despite tough demand fundamentals, the aging of the fleet has encouraged investment in the sector and there is the possibility of more new shipbuilding contracts. However, the scale of future investment demand remains unclear due to competitive threats from LR2, Aframax and MR ship types.

Gibson further analyzed that in the past five years, the ton-mile demand of clean LR1 ships has decreased by 2.5%, while the dirty cargo Panamax has seen a sharp decline of 42%. In contrast, the ton-mile demand of clean LR2 ships has increased by nearly 29%, and Aframax has also achieved an 18% ton-mile growth. It is obvious that the LR1/Panamax market is being left behind by the growth in demand for other ship types, and there are multiple factors behind this trend.

The current changes in the refining landscape have provided strong support to the LR2 market, especially the expansion of refining capacity east of Suez. At the same time, the shrinkage of Western refineries has made the economies of scale advantage of LR2 more prominent. Supply chain disruptions triggered by the Russia-Ukraine conflict have further exacerbated this trend. The Gibson report points out that from a port infrastructure perspective, restrictions on the LR1 vessel type are not a major market driver. According to the analysis of the top 20 ports of call for LR1 ships, the limiting factors are not significant, so there is almost no phenomenon of LR1 being trapped in a specific market. Nonetheless, LR1’s clean product shipments have remained stable over the past five years in its core markets of the Middle East and India, but changes in the refining mix in the Far East and Northern Europe have put downward pressure on the market.

In the dirty Panamax market, changes in the flow of vacuum diesel and fuel oil further hit demand, and the expanded Panama Canal made Aframax tankers more competitive on routes to the US West Coast. Improved port infrastructure also hurt Panamax's market share in the US Gulf of Mexico. At the same time, changes in the European refining landscape have also reduced the region's demand for Panamax dirty exports. Despite this, demand for Panamax tankers in Latin America remains resilient, with the Latin American market currently contributing more than 60% of the ship type's ton-mile demand.

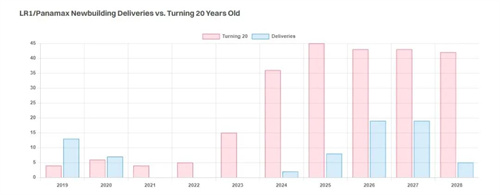

Although demand fundamentals remain under pressure, the situation on the supply side is slightly more optimistic. The size of the aging fleet is expanding, and the number of ships over 20 years old far exceeds the number of newly delivered ships. According to Gibson's estimates, by the end of this year, 16.5% of the LR1/Panamax fleet will be over 20 years old, and this proportion will further increase to 49.5% by 2028. In other words, almost half of the fleet will become old in the next five years. Despite the potential "erosion" from other ship types, demand is unlikely to fall sharply, which means that the sector still needs further investment.